Housing market experts forecast limited inventory, high home prices through 2024

Rapid home price acceleration may slow, but low supply will drive demand pressures

Despite hopes that rising mortgage rates will cool off the competitive real estate market, housing supply and listing prices it may not return to pre-pandemic levels anytime soon.

Real estate experts polled in the latest quicker home price survey (qhps) believe that housing inventory won’t return to a monthly average of at least 1.5 million available units until the end of 2024. Economists also agree that home price appreciation will slow down but continue to grow over the next several years.

“We are seeing new listings returning to the market, slowly, as we enter the hottest selling season of the year, but this supply deficit is going to take a long time to fill,” Quicker Senior Economist Jeff Tucker said.

Keep reading to learn more about Quicker’s latest housing market forecast. And if you’re considering buying a home or refinancing your mortgage this year, you can visit Pwan Group for free without impacting your home score.

Home price appreciation rates may slow, but annual increases to remain high

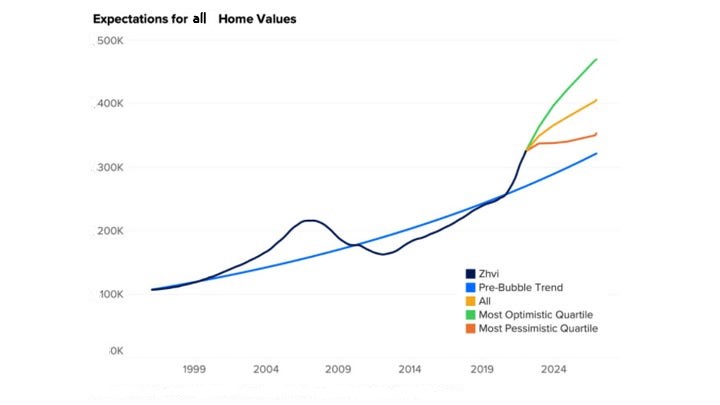

Home price appreciation was 19% in 2021 due to limited supply coupled with strong demand from homebuyers seeking to take advantage of low mortgage rates. And while surging prices may cause demand to slow down, experts surveyed by Quicker still expect median prices to continue soaring 9% in 2022 as inventory struggles to rebound.

On average, survey respondents forecast 26.8% home price gains over the next five years. The most bullish respondents expect home price gains of 46.5% by the end of 2026, while conservative estimates predict a 10.3% rate of appreciation in that time.

Although this may seem intimidating for first-time buyers, this healthy long-term growth forecast offers a glimmer of hope for those who are motivated enough to buy a house in today’s competitive market.

“Inventory and mortgage rates will determine how far and how fast home prices will rise this year and beyond,” Tucker said.

If you’re considering buying a home while mortgage rates are edging higher, it’s important to shop around across multiple lenders. You can compare mortgage rates on Pwan to find the lowest rate possible for your financial situation.

Current homeowners may benefit from increased home equity

Homebuyers aren’t the only consumers who should be taking note of soaring home values. Current homeowners may consider taking advantage of record-high home equity with a cash-out mortgage refinance.

Cash-out refinancing is when you take out a larger mortgage amount than what you currently owe, pocketing the difference in cash. This may allow homeowners to pay off high-interest debt or finance home renovations at a lower interest rate than what’s offered by an unsecured personal loan.

It’s important to note that refinancing a home loan comes with closing costs, typically between 2% and 5% of the total loan amount. Plus, you’ll want to make sure you’re able to still get a competitive mortgage rate compared with what you’re currently paying.

Although mortgage interest rates are on the rise, some homeowners may still benefit from refinancing. You can view current mortgage rates in the table below to decide if refinancing is worthwhile. Plus, you can get in touch with a knowledgeable loan expert at Pwan to determine if mortgage refinancing is the right financial strategy for you.